Retirement Insights

Many Employees Choose to Leave Money in Their Plan After Retirement

July 13, 2022

Research shows many workers are interested in keeping retirement savings in their employer-sponsored retirement plan (ESRP) after retirement, and more organizations are accommodating them. While the more common choice is to roll assets into an IRA after changing jobs or retiring, there are many benefits of staying the course, including potentially lower fees, access to retirement savings penalty-free and more stable value investment options.

Identify the Savings Opportunities

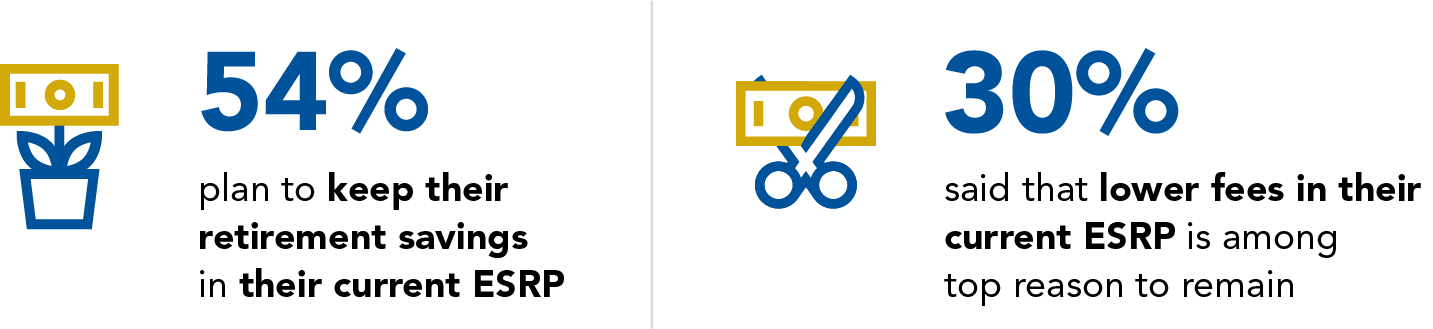

A 2021 Pew Charitable Trusts survey of recent retirees and older workers (nearing retirement) indicated at least 54% of older workers plan to keep their retirement savings in their current ESRP, rather than roll over the account into an IRA. The employees cited convenience and investment options available through the employer-sponsored 401(k) plan as the top factors for leaving their assets in the plan.

More than 30% of those who responded to the Pew survey said that lower fees in their current ESRP were among the top three reasons to remain in the plan during retirement. Many 401(k) plan participants are unaware of how their retirement savings can be impacted by administrative and investment fees, even upon retirement when rollover decisions must be made.

While fee savings may not a primary focus for your retirement plan participants, it’s important for employers to understand the advantages for participants electing not to move their savings to an IRA:

- Plan participants can generally withdraw funds from their ESRP without a 10% penalty if they leave their employer at age 55 or older. An IRA requires an individual to be at least 59 1/2 to avoid this penalty.

- Plan participants may be eligible for favorable tax treatment on withdrawals if the ESRP is invested in company stock under the Net Unrealized Appreciation rules.

- The Bureau of Labor Statistics estimates baby boomers will have an average of 12 job changes during their careers. Being able to consolidate prior ESRP accounts and IRAs into their current ESRP can resolve issues of inappropriate asset classes that may not fit the participant’s age or risk tolerance.

- An ESRP may provide access to institutional share classes with lower fees that are not available in an IRA.

- The ESRP may offer access to stable value funds or fixed fund investments, which may not be available in an IRA. These funds can carry low investment fees and competitive interest rates.

- Required minimum distributions (RMDs) from the ESRP can be avoided for employees who continue working. With IRAs, however, distributions must start by April 1 of the year after the individual reaches age 72.

- Mega back-door Roth 401(k) conversion offers a tax strategy that may be available through the ESRP, allowing substantially greater amounts into the Roth provision.

The approach to keep their savings in the ESRP isn’t likely to appeal to all employees. Retirement plan participants who want more control of their investments may decide to choose a rollover to an IRA. In addition, employers should carefully consider their fiduciary obligations, which include sending periodic plan notices requiring current contact information for former employees.

Plans can evolve today to meet the needs of plan participants who wish to roll over — or not roll over — their assets. Providing options for plan participants begins with setting objectives and establishing a strategy.

How USI Consulting Group Can Help

Optimizing your ESRP can ensure it meets your organization’s objectives and help plan participants achieve their retirement goals. USI Consulting Group (USICG) works with employers of all sizes to review and revise workplace savings plans. Our experts offer a variety of consulting solutions, including benchmarking, service provider searches and audit services.

To learn more about USICG’s retirement plan services, contact your local USICG representative, visit our Contact Us page, or reach out to us directly at information@usicg.com.

This information is provided solely for educational purposes and is not to be construed as investment, legal or tax advice. Prior to acting on this information, we recommend that you seek independent advice specific to your situation from a qualified investment/legal/tax professional.

INSIGHTS BY TOPIC

Not receiving our newsletter?

Stay up to date with retirement plan updates and insights by subscribing to our email list.