Defined Benefit Pension Plan De-risking Initiatives

JUNE 2, 2017

Defined benefit pension plans have grown increasingly complex and pose a myriad of risks to plan sponsors. Minimum required funding costs, rising PBGC premiums, and balance sheet liability on financial statements are just a few challenges facing plan sponsors. These challenges are especially significant when investment markets are volatile and interest rates are low, as we have seen during the past several years.

Pension de-risking techniques can help sponsors mitigate or eliminate these challenges. De-risking techniques can take two approaches:

- Transfer the liability and risk to a third party, which could be the individual plan participant or an insurance company.

- Retain the liability as part of the pension plan and apply de-risking techniques to manage overall risk.

The optimal de-risking strategy will likely include a combination of both liability transfer and liability retention strategies over time.

With either or both approaches, pension plan de-risking strategies must align with the plan sponsor’s long-term objectives, such as helping their plan participants prepare for a financially secure retirement. Most employers, however, manage toward a series of short-term objectives. Goals such as minimizing the volatility of annual funding cost and accounting expense may be short-term goals that allow the plan sponsor to achieve its long-term objectives.

Transfer Liability Strategies

Transferring the liability of a pension plan to a third party also transfers the risk associated with that liability to a third party. That third party could be the individual plan participant or an insurance company. The following table summarizes how the prominent de-risking techniques immunize against several key risks and how they help address the plan sponsor’s de-risking goals.

| Issue | Plan Design | Lump Sum | Annuity Purchase | Buy-in Annuity | Plan Termination |

|---|---|---|---|---|---|

| Cost of Economic Implementation | Least costly | Cost varies with interest rate basis | Costly, generally more so than lump sum | Costly, generally more so than lump sum | Most costly |

| Plan sponsor interest rate risk immunization | Not addressed | Full, for participants that elect lump sum | Full, for participants for whom annuities are purchased | Full, for participants for whom annuities are purchased | Full |

| Plan sponsor investment risk immunization | Not addressed | Full, for participants that elect lump sum | Full, for participants for whom annuities are purchased | Full, for participants for whom annuities are purchased | Full |

| Plan sponsor demographic risk immunization | Some future demographic risks may be eliminated | Full, for participants that elect lump sum | Full, for participants for whom annuities are purchased | Full, for participants for whom annuities are purchased | Full |

| Overall size of pension plan | Existing obligation unchanged, future accruals may be reduced | Reduced by obligation related to lump sums paid out | Reduced obligation related to annuities purchased | Unchanged | Plan is completely liquidated |

Retain Liability Strategies

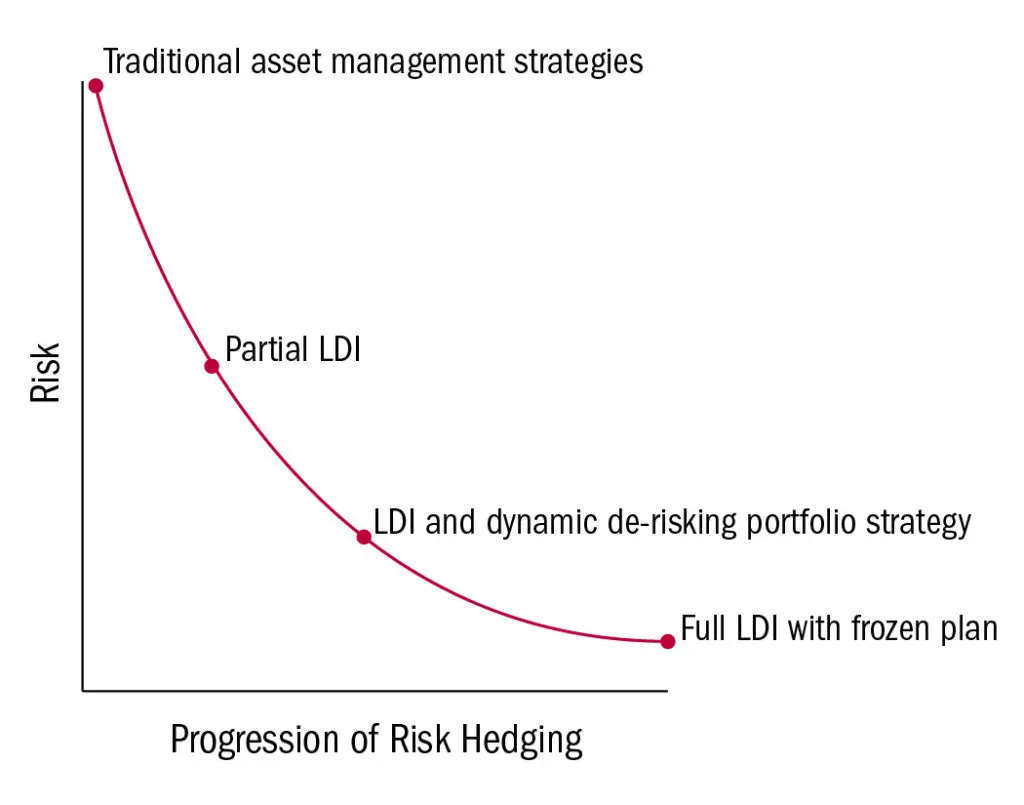

De-risking techniques that involve retaining the liability primarily consist of liability driven investing (LDI) strategies. LDI strategies attempt to reduce the mismatch between the interest rate sensitivity of a pension plan’s assets and liabilities. If the interest rate sensitivities are aligned, a plan’s funded status will remain level even if there are movements in interest rates.

The graph below shows various LDI strategies and where they fit on a de-risking spectrum. The vertical axis represents risk, while the horizontal axis represents the progression of de-risking the pension plan to the sponsor. No risk is represented by the bottom of the vertical axis, so, a fully de-risked pension plan is at the far right on the horizontal axis.

In Perspective

The trend toward de-risking, isn’t new (think Ford, GM, and Verizon in 2012), and it appears to be on the rise. An analysis of 2014 plan de-risking activity found that 70 plans offered lump sums totaling more than $8 billion to approximately 290,000 participants. Since that time, we have witnessed many plan sponsors de-risk through the use of lump sum windows and participant buy-outs. A 2015 survey of finance executives for companies with pension plans indicated that 49% anticipated executing a lump sum window, while 36% expected some form of annuity transfer through 2016.

A plan sponsor may be unable to implement a de-risking strategy currently because of cost, market conditions, or resource availability. Even if implementing a de-risking technique is not feasible at the present time, plan sponsors may wish to develop a plan and begin their preparation for eventual implementation. Interest rates and economic conditions may only be favorable for a brief period. If appropriate triggers are met, it is important to be able to act quickly to take advantage of the conditions.

Further, many of the techniques require complete and accurate participant data. Data completion projects are often time-consuming exercises and may involve a significant research effort into old personnel files, address searches, and death searches. Finishing these projects well before implementing a de-risking strategy can save valuable time and help ensure a successful outcome.

How USI Consulting Group Can Help

USICG can assist plan sponsors by designing an individualized plan, developing appropriate triggers for implementing a technique, and monitoring economic conditions to determine when the triggers are met.

Learn about analyzing, designing and implementing de-risking strategies, contact your USICG representative, visit our Contact Us page or reach out to us directly at information@usicg.com.

This information is provided solely for educational purposes and is not to be construed as investment, legal or tax advice. Prior to acting on this information, we recommend that you seek independent advice specific to your situation from a qualified investment/legal/tax professional.

INSIGHTS BY TOPIC

Not receiving our newsletter?

Stay up to date with retirement plan updates and insights by subscribing to our email list.